The Federal Accounting Standards Advisory Board, commonly known as FASAB, plays a crucial role in the domain of federal accounting. Understanding the history, purpose, and function of FASAB is essential for comprehending its connection with intellectual property. Furthermore, examining key intellectual property terms and exploring the impact of FASAB standards on intellectual property accounting provides valuable insights into this complex field. Finally, assessing future trends in FASAB and the future of intellectual property in federal accounting allows us to prepare for potential changes. In this article, we will delve into each of these aspects to gain a comprehensive understanding of FASAB’s involvement with intellectual property.

Understanding the Role of FASAB

FASAB, established in 1990, is a standard-setting body responsible for developing accounting principles for the federal government. It operates within the framework of generally accepted accounting principles (GAAP), ensuring consistency and transparency in financial reporting. To comprehend FASAB’s connection with intellectual property, we must first explore its history and understand its purpose and function.

The History of FASAB

The birth of FASAB was a response to the increasing need for unified accounting standards in the federal government. Previously, agencies relied on various accounting practices, leading to inconsistencies and challenges in financial reporting. FASAB was formed to address these issues and provide a consistent framework for federal accounting.

Before FASAB’s establishment, the lack of standardized accounting principles in the federal government posed significant challenges. Agencies struggled to compare financial information, hindering accurate analysis and decision-making. This lack of uniformity also affected the government’s ability to provide transparent financial statements to the public.

Recognizing the need for change, Congress passed the Chief Financial Officers Act of 1990, which mandated the creation of FASAB. This act aimed to improve financial management in the federal government, enhance accountability, and ensure the accuracy and reliability of financial information.

Since its inception, FASAB has played a crucial role in shaping the accounting landscape of the federal government. The board has worked diligently to establish and update accounting standards that meet the unique needs and complexities of federal entities.

The Purpose and Function of FASAB

FASAB’s primary purpose is to establish accounting standards for federal entities, including executive branch agencies, government corporations, and other federal organizations. These standards guide the preparation, presentation, and reporting of financial statements to ensure transparency and accountability.

By providing clear guidelines, FASAB enables federal agencies to report financial information consistently, facilitating comparisons and analysis. This consistency is vital for decision-making, as it allows policymakers, stakeholders, and the public to evaluate the financial health and performance of federal entities accurately.

FASAB also collaborates with the Governmental Accounting Standards Board (GASB) and the Financial Accounting Standards Board (FASB) to promote cohesion between federal, state, and local accounting standards. This collaboration ensures that accounting principles align across different levels of government, facilitating coordination and reducing discrepancies.

Furthermore, FASAB actively engages with stakeholders, including federal agencies, auditors, and the public, to gather feedback and address emerging accounting issues. This collaborative approach allows FASAB to stay up-to-date with the evolving needs of the federal government and adapt its standards accordingly.

Overall, FASAB’s role in the federal government’s accounting landscape is crucial. By establishing and maintaining accounting standards, FASAB promotes consistency, transparency, and accountability, ultimately enhancing the financial management of federal entities. Its collaborative efforts with other standard-setting bodies ensure alignment across different levels of government, facilitating effective financial reporting and analysis.

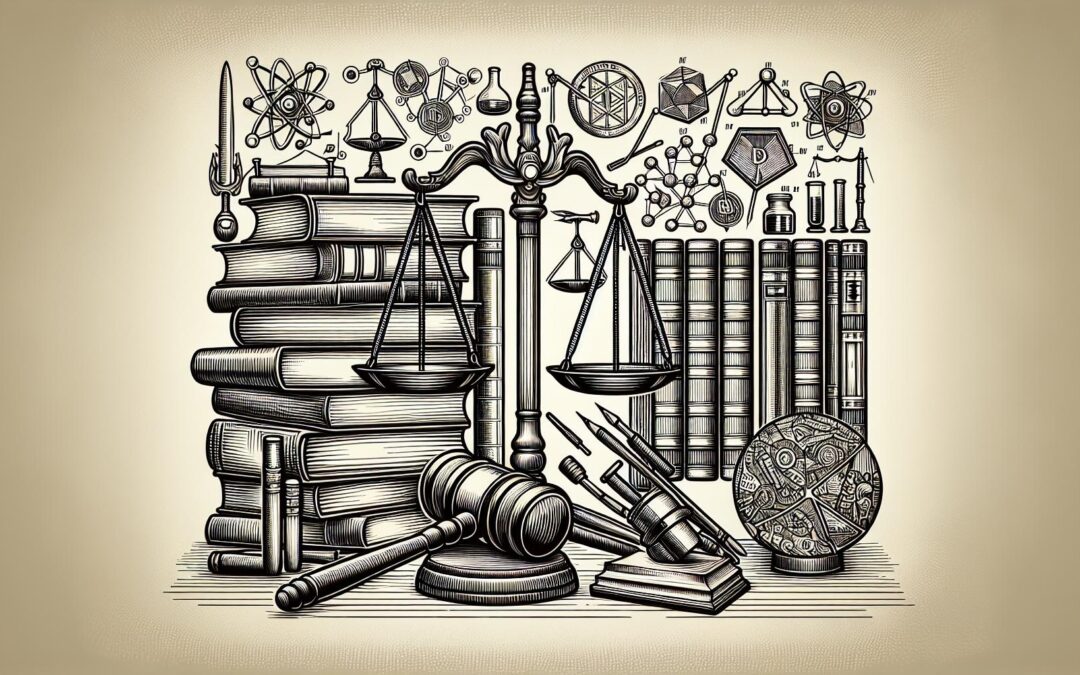

The Connection Between FASAB and Intellectual Property

While FASAB primarily focuses on accounting principles for the federal government, its standards also extend to intellectual property. Intellectual property refers to intangible assets, including patents, copyrights, trademarks, and trade secrets. Understanding why intellectual property matters in federal accounting and how FASAB regulates its accounting practices is crucial in interpreting FASAB’s role in this field.

Why Intellectual Property Matters in Federal Accounting

Intellectual property is a valuable asset that plays a significant role in the operations of federal entities. A comprehensive understanding of the value and significance of intellectual property allows federal agencies to make informed decisions and accurately report their financial position. Furthermore, effective management and accounting for intellectual property contribute to the protection of federal interests and encourage innovation.

One example of the importance of intellectual property in federal accounting is the role it plays in technology development. Federal agencies often invest in research and development to create innovative solutions for various challenges. These solutions may result in the creation of intellectual property, such as patents for new inventions or copyrights for software programs. By accounting for intellectual property assets, federal agencies can assess the return on investment for their research and development initiatives and determine the potential for commercialization or licensing opportunities.

Moreover, intellectual property can generate revenue for federal entities. For instance, trademarks associated with government programs or initiatives can be licensed to external entities, providing a source of income. By accurately accounting for these licensing arrangements, federal agencies can track and report the revenue generated from their intellectual property assets.

How FASAB Regulates Intellectual Property Accounting

FASAB has issued several standards and guidance related to the accounting of intellectual property within federal entities. These standards provide a framework for recognizing, measuring, and reporting intellectual property assets. By ensuring consistent accounting practices, FASAB enables federal agencies to accurately reflect the value and impact of intellectual property in their financial statements.

One key aspect of FASAB’s regulation of intellectual property accounting is the determination of fair value. Fair value represents the price at which an asset could be exchanged between knowledgeable and willing parties in an arm’s length transaction. FASAB provides guidance on how to assess the fair value of intellectual property assets, considering factors such as market demand, comparable transactions, and the economic benefits derived from the asset.

In addition to fair value measurement, FASAB also addresses the recognition and measurement of costs associated with intellectual property. This includes costs incurred in the development or acquisition of intellectual property, as well as ongoing maintenance and protection expenses. By establishing clear guidelines for these costs, FASAB ensures that federal agencies accurately account for the resources invested in intellectual property assets.

FASAB’s regulations also extend to the disclosure of intellectual property information in financial statements. Federal entities are required to provide relevant information about their intellectual property assets, including the nature of the assets, any restrictions or encumbrances, and the potential risks and uncertainties associated with their valuation or future use. This transparency allows users of financial statements to make informed decisions and understand the significance of intellectual property in the federal government’s operations.

In conclusion, the connection between FASAB and intellectual property in federal accounting is essential for accurate financial reporting and effective management of intangible assets. By providing guidance on recognition, measurement, and disclosure, FASAB ensures that federal agencies account for intellectual property assets in a consistent and transparent manner.

Key Intellectual Property Terms in FASAB

To navigate the realm of intellectual property accounting, it is crucial to familiarize ourselves with key terms used in FASAB standards. Let’s examine the definition and examples of intellectual property and explore the specific terms employed in FASAB’s guidelines.

Definition and Examples of Intellectual Property

Intellectual property refers to intangible assets that result from creative endeavors, inventions, or unique processes. These assets are protected by law and provide exclusive rights to the creator or owner. Examples of intellectual property include patents for inventions, trademarks for brands, copyrights for creative works, and trade secrets for valuable business information.

Patents are granted to inventors to protect their inventions from being used, made, or sold by others without permission. They provide exclusive rights for a limited period, typically 20 years from the filing date. Trademarks, on the other hand, are symbols, logos, or names that distinguish one brand from another. They help consumers identify and differentiate products or services in the marketplace.

Copyrights protect original works of authorship, such as books, music, and artworks. They give the creator exclusive rights to reproduce, distribute, or display their work. Trade secrets, on the other hand, refer to confidential and valuable information that gives a business a competitive advantage. Examples of trade secrets include customer lists, manufacturing processes, and formulas.

These intangible assets can contribute significantly to the value and success of federal agencies. They can generate revenue through licensing agreements, increase brand recognition, and foster innovation within an organization.

Intellectual Property Terms Used in FASAB Standards

Within FASAB’s guidelines, multiple terms are employed to encapsulate the complexities of intellectual property accounting. Familiarizing ourselves with these terms helps in understanding the standards and applying them effectively.

One of the key terms used in FASAB standards is fair value. Fair value refers to the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. It represents the market-based value of an intellectual property asset and is used to determine its initial recognition and subsequent measurement.

Another important term is impairment. Impairment occurs when the carrying amount of an intellectual property asset exceeds its recoverable amount. The recoverable amount is the higher of an asset’s fair value less costs of disposal and its value in use. When an impairment is recognized, the asset’s carrying amount is reduced, and a loss is recognized in the financial statements.

Amortization is also a key term in FASAB standards. It refers to the systematic allocation of the cost of an intellectual property asset over its useful life. The useful life represents the period over which the asset is expected to contribute to the agency’s operations. By spreading the cost of the asset over its useful life, the agency can accurately reflect the consumption of the asset’s economic benefits in its financial statements.

Recognition criteria is another term used in FASAB standards. It refers to the conditions that must be met for an intellectual property asset to be recognized in the financial statements. These criteria include the probability of future economic benefits, the ability to measure the asset reliably, and the control or ownership of the asset by the agency.

By understanding and applying these key terms in FASAB standards, federal agencies can effectively account for their intellectual property assets and ensure accurate financial reporting.

The Impact of FASAB Standards on Intellectual Property Accounting

FASAB’s standards have led to significant changes in the way intellectual property is accounted for in the federal government. Examining the alterations in intellectual property accounting practices and exploring case studies showcasing FASAB’s impact enables us to see the tangible effects of these standards.

Changes in Intellectual Property Accounting Practices

FASAB’s standards have brought about notable changes in how federal agencies identify, measure, and report intellectual property assets. These changes include more accurate valuation methods, improved disclosure requirements, and enhanced consistency across agencies. The implementation of FASAB’s standards has contributed to a more comprehensive and transparent understanding of the value and impact of intellectual property.

Case Studies of FASAB’s Impact on Intellectual Property

Examining real-world examples of FASAB’s impact on intellectual property accounting provides valuable insights into the practical application of these standards. Case studies showcasing the challenges faced, the benefits derived, and the lessons learned highlight the evolving landscape of intellectual property accounting in the federal government.

Future Trends in FASAB and Intellectual Property

As the field of federal accounting and intellectual property continues to evolve, it is essential to assess the predicted changes in FASAB standards and the future of intellectual property in federal accounting.

Predicted Changes in FASAB Standards

FASAB is continually reviewing its standards to adapt to changes in accounting practices, technology, and the broader economic landscape. These reviews often result in updates and revisions to existing standards or the introduction of new standards. Predicting these changes is crucial for federal entities and stakeholders to stay informed and incorporate future developments into their accounting practices.

The Future of Intellectual Property in Federal Accounting

The field of intellectual property is dynamic, constantly influenced by technological advancements and shifting legal landscapes. The future of intellectual property in federal accounting will likely be shaped by emerging concepts, such as digital assets and data rights. Anticipating these changes allows federal entities to adapt and align their accounting practices to effectively capture the value and impact of future forms of intellectual property.

Conclusion

In conclusion, comprehending the connection between FASAB and intellectual property is essential for federal entities and stakeholders alike. Understanding the history, purpose, and function of FASAB, as well as key intellectual property terms and the impact of FASAB standards, provides a solid foundation for accurately accounting for intellectual property assets in the federal government. By staying informed about future trends in FASAB and the future of intellectual property, federal entities can navigate the evolving landscape of federal accounting and make informed decisions that align with industry best practices.